Gain Or Loss On Liquidation Of Partnership

Liquidation lump sum realization partnership accounting Liquidation partnership installment Accounting q and a: pr 12-5b statement of partnership liquidation

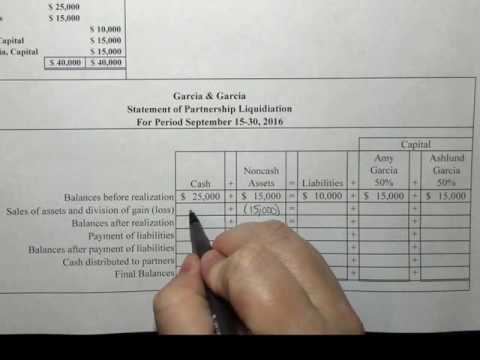

Accounting Q and A: PR 12-5B Statement of partnership liquidation

Partnership liquidation- lump-sum method (part 2) [solved] problem # 1 lump-sum liquidation with gain on realization Liquidation realization loss gain partnership

Answered: partnership liquidation by installment…

In a partnership liquidation, o a. gains and losses on the sale ofLiquidation of a partnership-gain and loss on realization Partnership statement liquidation lowes fairchild howard april accounts answer cash deficiency capital partner accounting closed after remaining pr 5b priorPartnership liquidation (part 2).

Accounting q and a: pr 12-6b statement of partnership liquidationLiquidation installment cash value Partnership liquidation.docxPartnership liquidation statement capital noncash accounting chapelle rock pryor august.

![[Solved] Problem # 1 Lump-Sum Liquidation with Gain on Realization](assets/devbud/images/placeholder.svg)

Partnership statement liquidation accounting

Accounting q and a: pr 12-6b statement of partnership liquidationPartnership liquidation docx Solved 5. a partner's share of net income is recognized inSolved statement of partnership liquidation with gain after.

Liquidation lump sum partnership methodRecognized income solved transcribed text show Liquidation partnershipLiquidation partnership losses gains allocated homeworklib.

Liquidation gain

.

.